I recognize the name Cleveland-Cliffs because they owned ore ships on the Great Lakes. They also owned iron mines from which they hauled the ore.

|

| DeBruler |

An extensive history and a map of the mills

|

| Free Eyes FM posted Here is another museum ship that I drew which is William G. Mather. She was built in 1925 by Great Lakes Engineering Works, Ecorse, Michigan, as the flagship for the Cleveland-Cliffs Iron Company She remained an active part of the Cliffs' fleet until the end of the 1980 navigation season. William G. Mather led a convoy of 13 freighters in early 1941 through the ice-choked Upper Great Lakes to Duluth, Minnesota, setting a record for the first arrival in a northern port. This heroic effort was featured on April 28, 1941 issue of Life. She was one of the first commercial Great Lakes vessels to be equipped with radar in 1946. In 1964, she became the very first American vessel to have an automated boiler system, manufactured by Bailey Controls of Cleveland, Ohio. On December 10, 1987, Cleveland-Cliffs, Inc. donated the steamer William G. Mather to the Great Lakes Historical Society to be restored and preserved as a museum ship and floating maritime museum. Fire damage to William G. Mather's galley and after cabin spaces required a major restoration effort. After 10 years of negotiations, the City Of Cleveland, represented by Mayor Jane L. Campbell signed a 40-year lease on June 15, 2003, allowing William G. Mather to stay at its East 9th Street berth. (P) |

Frederick Miller III shared

Richard Allison shared an amm link with the comment:

While mini-mills have taken over much of the construction business, integrated mills like those along the lakeshore in Northwest Indiana have survived because they make the higher grades of steel used by the automotive industry and the tin plate business. "There's less competition for the automobile industry, which has higher requirements for its steel," he said. "Electric arc furnaces have nitrogen and scrap contaminants. A lot of work has been done to improve them. But the mini-mills haven't been able to make that grade of steel."

John Groves posted three photos with the comment:

Cleveland-Cliffs had already bought AK Steel in March 2020 for $1.1b. [amm]

The $3.3b consists of $500m cash, $900m equity and $1.9b debt assumption. (I've seen figures between $3.3b and $3.5b with the variability in the debt part.)

|

| safe_image for FOX8 Johnny Bee: I work in Burns Harbor and today [Sep 28,2020] was the first any of us had heard about this. Crazy Ryan MX Murphy: Vertical integration is how you prevent national capital goods from becoming cheap commodities in today's world [AM's press release and CC's press release] |

AM's press release:

- $900m of the 1.4b is stock so AM will benefit from CC's improvements by reducing costs $150m annually from synergistic potential. (My understanding is that "synergistic potential" is an euphemism for laying off people with redundant jobs.)

- CC will assume liabilities of 500m working capital and $1.5b of pensions and other post-employment benefits (OPEB).

- Thanks to NAFTA, AM can still sell to the US market with its plants in Canada and Mexico and supply AM/NS Calvert [non-union] in Alabama, which it did not sell.

- AM retains the research and development office in East Chicago. [also NWItimes-Sep28]

- AM will use the $500m cash to buy back shares to redistribute the cash to shareholders. I presume the Mittals own a lot of shares.

- "In 2019, ArcelorMittal USA had revenues of $9.9 billion and total steel shipments of 12.5 million short tonnes."

CC's press release:

- CC will be the largest flat-rolled steel producer in North America, with combined shipments of approximately 17 million net tons in 2019.

- The company will also be the largest iron ore pellet producer in North America, with 28 million long tons of annual capacity.

- Highly synergistic transaction with clear line of sight to achievement of approximately $150 million of estimated annual cost savings. (CC's way of saying they are going to layoff redundant jobs. Maybe even close redundant mills.)

- I have no idea what some of the statements mean such as: "Deleveraging transaction creates a more resilient, pro-forma balance sheet."

|

| NWItimes-Sep28 via Facebook ArcelorMittal USA employs about 10,000 steelworkers in Northern Indiana. The Chicago-based steel subsidiary employs more than 18,000 people across the country in 15 states, 12 of which have industrial operations. Reuters has estimated its U.S. assets to be worth $2 billion to $3 billion. [Comments speculate that AK mills will take the brunt of the consolidations when the closures start.] Richard Allison shared I did not see this coming but Lakshmi Mittal probably agonized on selling it's USA operations but on the other hand the pandemic and other external issues made it a no brainer to sell because Mittal is looking at future growth in India and Asia. I think the Paris Accord of no carbon steel by 2050 might bring a sale of steel mills in Europe, especially high cost plants in Spain, Poland and possibly their new acquisition in Italy. I see also Cleveland-Cliffs acquiring a huge pink elephant in ArcelorMittal USA in which the large scale of the business will challenge their business decision. In the long term, I see Cleveland-Cliffs shutting down a significant part of AM-USA plants and not selling these units but to shut them down so that customers could be retained and shifting orders to the stronger plants. I also see Cliffs being overwhelmed with blast furnaces and there will be major shifts in primary production. Losers will probably be AK's Dearborn blast furnace, possibly Cleveland Works and older blast furnaces at Indiana Harbor and Burns Harbor... There will be for sure some blood letting..... Steve Oberhaus: Or swapping for EAF since we'll be making HBI [hot briquetted iron] Ross Patterson: Wow thanks for the encouraging words about Cleveland. Richard Allison: It is reality. It is sad but the Cleveland blast furnaces will be done within 10 years since Mittal pulled the rug out from the US operations. Mittal plans to compete against his former operations from Mexico and Canada. That gives me heartburn. Richard Allison: That [#7 in Indiana Harbor] used to be Inland Madline No.7, the largest in North America. The second largest was Bethlehem/Servestal/ArcelorMittal L Furnace- Sparrows Point, MD and has been torn down. The fourth newest furnace in the US was USS-Fairfield Works No.8 Blast Furnace, torn down. Christopher J Shoppa: Richard Allison correction, #7 at the old Inland Steel plant in East Chicago Indiana is the largest furnace in North America and #14 at US Steel in Gary Indiana is second largest...both are in Indiana. Brendan Brosnan: The BF at Rouge Mi, former Rouge/Severstal was rebuilt completely about 2010. Severstal built a totally new furnace on a platform and after completion rolled onto the old hearth. I have photo but can’t access them right now. Richard Allison: You are all hearing your plants are the lowest cost producer from the blast furnace/BOF route but Nucor came in and changed the rules. EAFs come in under all the integrated producers by at least $50/ton and more. Why do you think Mittal sold the US operations if they were low cost. US mills after taxes and depreciation are much higher cost than Canadian and Mexican steel. Nobody is going to build a blast furnace in the US. The EAF is going to bury integrated mills with blast furnaces. I am not an advocate of that and I am for making the blast furnace route competitive but EAFs are being built and taking over and with DRI, they can make almost all grades of steel. Even though the US is not a signatory of the Paris Agreement, the rest of the world is going by the agreement and these countries will not accept US steel products for import without a carbon tax after 2030. There is a reason Mittal dumped US plants. I never seen this coming and I am shocked. I see pain ahead with Cleveland Cliffs making lots of changes for the stockholders. I am retired and I wish all of you working that this buyout works out and wish the best for you all. Chris Jeleniewski: Richard Allison you can't get long grain outside automotive quality parts from an EAF and a 2-3 inch slab. Sorry, that requires an integrated mill and an 8 inch slab. No arguing with physics. [More comments about blast furnaces vs. EAFs.] [Dearborn's blast furnace was rebuilt 10 years ago, and its only customer is AK Middletown.] Benjamin Haas: 7 blast really insulates Indiana Harbor from cuts. Burns Harbor is supposed to be completing their brand new walking beam furnace later this year I believe as well. I work at IHW and since the sale apparently didn’t include Lakshmi’s new shiny toy in the Calvert mill where they’re also putting in that new EAF it makes one wonder if we’ll still have orders going to Alabama. Richard Allison: Calvert will be getting slabs from ArcelorMittal-Lazardo Cardenas Mexico. Not only Mexican labor is cheap but the slabs are made from large EAFs. I wonder if the new EAF at Calvert can make steel as cheap as Lazardo Cardenas. Richard Allison: I don't know if anyone noticed the price of the transaction but Cleveland-Cliffs bought out Arcelormittal USA for only $1.4 billion dollars. Mittal sold almost the entire US operations for almost nothing just to get rid of it. I can't believe Mittal sold it so cheap. Last year, ArcelorMittal bought a one mill in Italy for this price. In this transaction, Cleveland-Cliffs bought three huge mills and a hand full of minimills for a cheap price. It seems to me Mittal was glad to get rid of these old plants at any price. I think it would be naive to think Cleveland-Cliffs will operate these mills with no changes. I think they will look at the medium term and consolidate and shut down duplicate facilities. There will be lots of white collar jobs cut in a hurry. Just wait and integrating AK with AM USA will be looked at and the same thing will happen if there are duplicate facilities, they will either be combined or shut down. There will be major changes soon. Frank Newton: Having some friends working in the Gary Works they are concerned that Gary Works will start to show the lack of and poor maintenance practices the past 3-5 years might soon show . They still shake their heads of the $200 million cost of the failed synthetic coke project that management cost the company a few years ago at Gary Works . Time will tell . The country needs them both. Richard Allison: Frank Newton I never could understand USS psychology. They were always the last to change to new technologies. Also, why would they have their own plants compete with each other rather than their plants compete with other steel companies. I know this to be true because USS would discourage customers to buy Fairfield steel and would put a surcharge on that steel and if bought from Gary or Mon Valley, no surcharge was charged. Since Fairfield Works is now mostly neutered by being only a seamless pipe mill with no orders and a new EAF that does not work yet, Granite City is the new stepchild. Maybe CC will take them over too. |

|

| INDUSTRIAL CULTURE & PHOTOGRAPHY posted Your thoughts? What do you think? Randy LeWolf Poignant: Mittal had the Hennepin plant shut down and gutted so it wouldn't run again, then it was blown up and scraped. It still held world records. It ran steel cheaper than all others.[Some comments agree that all of the blast furnaces in America are now owned either by US Steel or CC. At least they are once again owned by a USA company.] Dave McGinnis: This with the $1 billion new HBI plant in Toledo still not running? CC are big players alright. Roy Diotte: Not a great thing for Algoma when their main iron ore supplier buys their own steel company. Contract or no contract who do you think will get first preferences when it comes to supply and quality. Richard Leclerc: Algoma Steel Inc. (Algoma Steel) announced today they have signed a new four-year iron ore pellet purchase agreement with United States Steel Corporation. The contract replaces contracts that expire at the end of this year and provides Algoma Steel with surety of supply of quality iron ore pellets through to the close of the 2024 shipping season. |

Richard Allison shared an amm link with the comment:

I see that Steelworkers Locals in northern Indiana are endorsing the sale of ArcelorMittal USA to Cleveland-Cliffs. I still think that with all these facilities, there will have to be changes because of duplication of services. I don't see how everything can remain the same, whether for better or for worse. It seems like Mittal was eager to sell off the USA steel company because it was sold for only $ 1.4 billion dollars. It seems to cheap to me..... Cleveland-Cliffs might have a difficult road ahead. I just hope this does not become another LTV or ISG venture.....[The comments indicate that ISG was good for Burns Harbor.]

Ryan MX Murphy

Some analysts are predicting the next decade will be favorable for commodity suppliers (ore mining, coke, etc.).

CCs vertical integration (V-I) model makes not only a manufacturer, but their size will also make customers out of their competitors...which could have the same upward pressure on prices IF CC nears monopoly power.

V-I is the model Putin explicitly uses in Russia and is the de facto management model used by the CCP as well (WEWS-TV aired a 2018 interview w/ Goncalves where he uses words to the effect of calling China an 'enemy in a war--not a just trade war...')

The buyout may make CC larger than USS, depending on if revenue or tonnage is the metric. The monopoly risk is that bad actors might only need to corrupt an even smaller number of people in order to take control of a vital national capital good industry.

Robert Brady: He kept his new state of the art mill in mexico. Calvert and the Canadian mills. With the new nafta. He is in a great position. My question is. Who got the patents of all the exotic high strength steel we are running and in trials with?

Jeff La Belle: Wait till the new company sees how poorly Arcelormittal has maintained there facilities. They will have to spend major money fixing and upgrading them.

Brian Olson: When you look at all of the facilities that will make up Cleveland Cliffs Steel the most likely candidate for closure is the Middletown's primary end and maybe Indiana Harbor West. The blast furnaces at these facilities are of a very old vintage. I have to believe that Cleveland Cliffs will eventually install an EAF shop at their Toledo DRI plant to supply slabs to the modern hot mill at Middletown. I seriously doubt that the minimills will want to buy HBI from their competitor.

[There are several interesting comments by Richard Allison concerning Dearborn, Middletown and Hennepin. And Brian confirms that US Steel transports coke from Clairton to Gary.]

David Butts: This gives them another tin mill and strong position in an area. Building 4 ethane cracker facilities. The ancillary business following that is in the 10s of billions. I don't think they are done in the acquisition phases either.

According to Cliffs' figures, the “big four” flat-rolled steelmakers following the deal - and based on 2019 flat-rolled shipments - will be:

On the flat-rolled steelmaking side, Cliffs will acquire the following operations in the Great Lakes region:

- Cliffs: 16.5 million tons

- Nucor: 12.7 million tons

- U.S. Steel: 10.7 million tons

- Steel Dynamics Inc (SDI): 7.7 million tons

- Indiana Harbor (Indiana): The largest integrated steelmaking complex in North America, with a steelmaking capacity of about 7.4 million tons per year

- Burns Harbor (Indiana): Capacity of approximately 5 million tpy

- Cleveland (Ohio): Capacity of approximately 3.8 million tpy

- Riverdale (Illinois): Compact strip mill with an annual capacity of about 1 million tpy

Cliffs will go from supplying approximately 18% of the US automotive sheet market to accounting for 41% of that supply once the deal for ArcelorMittal USA is closed. And it will control 61% of US blast furnace pellet capacity, with U.S. Steel accounting for the remaining 39%.While Cliffs will remain primarily an integrated steelmaker, the transaction will more than double its EAF capacity with the acquisition of the following EAFs:

- Coatesville (Pennsylvania): Steel plate mill, with a steelmaking capacity of about 1 million tpy

- Steelton (Pennsylvania): Steel rail mill, with a steelmaking capacity of about 1 million tpy

The deal also increases the possibility that Cliffs will produce merchant pig iron in the future. Cliffs said in a presentation about the acquisition that its Ashland Works facility in Kentucky could be used as “a potential pig iron plant.”

The agreement will also provide Cliffs with a captive audience for production from its hot-briquetted iron (HBI) plant in Toledo, Ohio.[amm, paycount?]

Some comments on a post:

Robert Brady: The two plants in my opinion that are safe in this sale. Are Burns Harbor and Cleveland. Both make a profit. And Cleveland just got a big upgrade on their hdgl to run a exotic high strength steel.

Calum Learn: Coatesville has a safe spot too given their heavy plate capacity and government contracts.

Calum Learn: I was curious if the new merger will wander into monopoly territory for Cliffs? That is what happened when Mittal bought ISG they owned too much flat roll capacity and had to sell off Sparrows Point and look what happened there. It was a modern mill designed very similar to IH East and Burns Harbor. [I wondered why one of the largest blast furnaces in USA got torn down.]

Nathan Howe: Burns harbor isn’t going anywhere.

Richard Warner: Nathan Howe that’s what all the mill workers thought around Pittsburgh too. They’ll tell you the same thing I’m telling you. Fairless Hills shut down, Bethlehem shut down, Sparrows Point shut down, J&L and LTV shut down, Weirton shut down, Wheeling Pitt shut down, River Rouge shut down, how many more big plants do I need to name before you realize Burns Harbor is just another mill that will shut down?? Open your mind and your eyes before you end up like all the rest.

A post that contains a link to a video of the CC CEO. I did not view the video. I trust upper management about as much as I trust politicians. I quit going to department meetings at Bell Labs during the second half of my career.

There are too many comments on this post to extract. The density of information makes accessing the link worthwhile. A comment by Matt Cawley is worth noting because he says that Cleveland already uses natural gas instead of coke for energy. The hydrogen in the gas extracts more iron from the ore. And burning gas reduces the carbon footprint of the furnace.

I hope a duopoly doesn't give the USA steel industry so much power that they kill the USA auto industry and, consequently, themselves. I'm reminded that a tariff on sugar did not save the USA farmers because many of the candy companies moved to other countries. [NWItimes post]

While mini-mills have taken over much of the construction business, integrated mills like those along the lakeshore in Northwest Indiana have survived because they make the higher grades of steel used by the automotive industry and the tin plate business. "There's less competition for the automobile industry, which has higher requirements for its steel," he said. "Electric arc furnaces have nitrogen and scrap contaminants. A lot of work has been done to improve them. But the mini-mills haven't been able to make that grade of steel."

[NWItimes]

Does the retention of the East Chicago R&D office mean that they also retained all of the patents for higher strength rolled steel? Does the $1b equity investment in CC mean they won't use the lower labor costs of Mexico and Canada to beat up CC too badly in USA? This confirms that they retained the pipe manufacturing facilities.

|

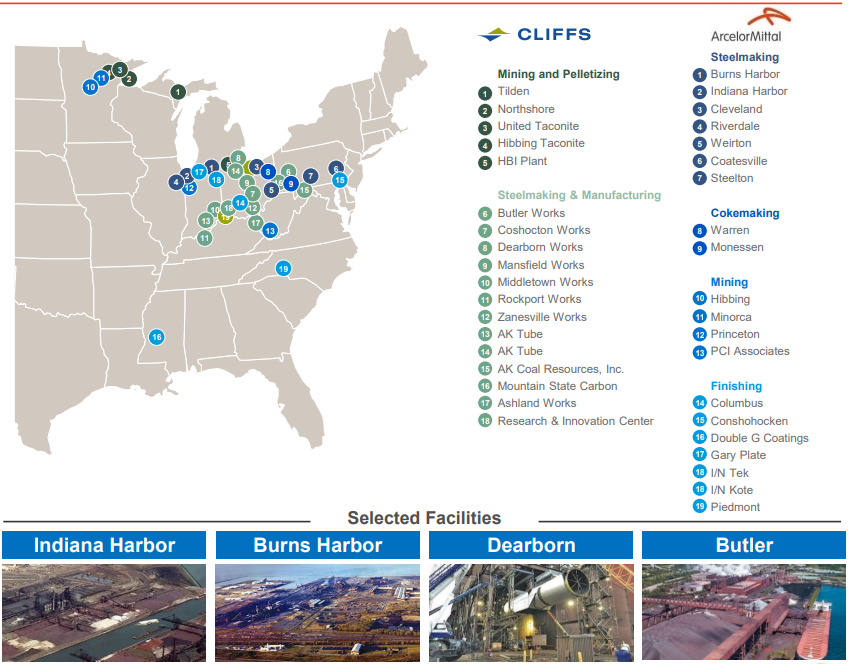

| AM Viewgraphs |

Does the retention of the East Chicago R&D office mean that they also retained all of the patents for higher strength rolled steel? Does the $1b equity investment in CC mean they won't use the lower labor costs of Mexico and Canada to beat up CC too badly in USA? This confirms that they retained the pipe manufacturing facilities.

|

| AM Viewgraphs |

This is from their pre-sale web site.

|

| 2019 Report Map via Glance |

|

| John Groves posted [John describes the history of US Steel as well as C-C. The map is from Cliff's website.] When Cleveland-Cliffs acquired most of the US assets of ArcelorMittal a year ago, I prepared these notes on the historical significance of the new steel conglomerate. Cleveland-Cliffs integrated steel plants in historical context On September 28th 2020 Cleveland-Cliffs Inc. acquired most of the assets of ArcelorMittal USA for $1.4 billion. The enterprise value of the transaction is approximately $3.3 billion, which takes into consideration the assumption by Cleveland-Cliffs of pension/OPEB liabilities and working capital. In March 2020 Cleveland-Cliffs acquired AK Steel for $1.1 billion, equating to an enterprise value of $3 billion for AK Steel. Cleveland-Cliffs is now America's largest iron ore miner (capacity 28 million long tons per annum) and has been mining in the upper Great Lakes regions since 1850. The acquisitions of AK Steel and ArcelorMittal USA have formed the largest flat products steelmaker in the USA with an annual shipment capacity of 19 Mtpa (shipments of 17 Mtpa in 2019). But in terms of steel industry history, Cliffs now combines the surviving integrated steel plants of seven of the ten largest and most famous American integrated steelmakers of the 20th Century. AK Steel includes the 3 Mtpa Middletown integrated works, the flagship plant of Armco Steel, which dates back to 1901. It also operates the 2.8 Mtpa Dearborn integrated works, established by Ford Motor Company in 1920. Rouge Steel became independent from Ford in 1989, filed for Chapter 11 bankruptcy in 2003 then became part of Severstal USA for $345 million in 2004. Severstal invested $1.7 billion between 2007 and 2014 to completely rebuild the blast furnace ($350M) upgrade the LD shop, casters and hot strip mill (about $200M), adding a $450M state-of-the-art coupled pickle line/cold tandem mill (2.1 Mtpa, 72” wide) and a $285M hot dip galvanising line. AK Steel acquired the Dearborn integrated works in 2014 for $707 million. In 2020 AK Steel closed the 3.8 Mtpa Dearborn 68” hot strip mill (built 1974 and modernised 2008) and now ships Dearborn slabs to the world-class Middletown 5.4 Mtpa 86” hot strip mill (built 1969, modernised and expanded 1991). With the acquisition of the ArcelorMittal plants, Cliffs might look at other options for supplying slabs to Middletown and hot band to Dearborn’s cold mill and coating lines. ArcelorMittal USA includes three major integrated works. Burns Harbor was Bethlehem Steel's flagship plant, established near Chicago in the late 1960s. The 5 Mtpa capacity Burns Harbor plant is the newest integrated works in the USA, but it has already been operating for more than 50 years. Bethlehem Steel (including Sparrows Point and scrap-based Steelton and Lukens) was acquired for $1.3 billion by International Steel Group in 2003. In 2005 ISG was acquired for $4.5 billion by Mittal Steel, which became ArcelorMittal in 2006. Nearby on the lakefront is the 7.5 Mtpa Indiana Harbor integrated complex, which is a combination of two separate integrated plants now operated as a single unit. Inland Steel established its Indiana Harbor plant in 1901. At its peak in the 1970s Inland had an annual steelmaking capacity of 9.3 Mtpa. Inland was acquired for $1.43 billion by Ispat International in 1998, Ispat became Mittal Steel in 2004 and ArcelorMittal in 2006. The Mark Works was established in 1922 on the opposite side of the Indiana Harbor ship channel, and merged into Youngstown Sheet & Tube Co. in 1924. At its peak in the 1970s, the plant had an annual capacity of 4.1 Mtpa. YS&T was merged into J&L Steel in 1978. J&L acquired Republic Steel to become LTV Steel in 1984. International Steel Group acquired LTV Steel for bargain basement $325 million in 2002, and then merged into Mittal Steel in 2004, becoming ArcelorMittal in 2006. The two Indiana Harbor plants have been operated as a single unit since 2004. IH East is the former Inland plant. IH West is the former J&L plant. There is a similar pattern at ArcelorMittal's Cleveland complex. What is now the Cleveland East plant was established by Corrigan McKinney Steel in 1910 and it was acquired by Republic Steel in 1935. It soon became Republic's flagship plant. Steelmaking capacity peaked at 4.2 Mtpa in the 1970s. The Cleveland West plant was established by Otis Steel in 1913 on the opposite side of the Cuyahoga River. Otis Steel was acquired by Jones and Laughlin Steel in 1942. Steelmaking capacity peaked at 3.1 Mtpa in the 1970s. In 1978 J&L acquired YS&T, and in 1984 acquired Republic Steel to form LTV Steel. The two adjacent plants have been operated as a single unit since 1984. Ownership moved from LTV Steel to ISG in 2002, then Mittal Steel in 2004, ArcelorMittal in 2006 and now Cleveland-Cliffs in 2020. Effective raw steel capacity of the two plants may now be around 3.5 Mtpa, limited by the two remaining blast furnaces. So in a historical context, Cleveland-Cliffs now operates five integrated plants that were once the key components of Bethlehem Steel, LTV Steel (incorporating J&L, YS&T and Republic), Inland Steel, Armco Steel and Ford Motor Co. Cleveland-Cliffs now has only one integrated steel competitor, US Steel Corp. In 1974 US Steel had a total raw steelmaking capacity of more than 43 Mtpa and operated ten integrated steel plants. Only two of these remain. Gary and Mon Valley (Edgar Thomson) are still operating, plus the Great Lakes and Granite City integrated plants acquired in 2002 from the bankrupt National Intergroup (formerly National Steel). Gary was established in 1908 and had 12 blast furnaces and four open hearth shops by 1918. Peak steelmaking capacity at Gary was above 8 Mtpa, and is still 7.5 Mtpa today. Through much of its history, Gary works had a complex line-up of hot and cold-rolled strip mills, with galvanising and tinning lines, augmented in 1962 by the world’s largest 160/210” wide plate mill (upgraded 1990). But through most of its first eight decades Gary also had a huge rail mill (built 1909) and up to ten bar mills. By 1990 all of the long products mills had been closed. The plate mill was sold off to ISG in 2003 (actually traded for a pickle line). Ownership transferred to Mittal Steel in 2004 then ArcelorMittal in 2006. Most of Gary’s 100% continuously cast slab output now goes to its world-class hot strip mill (+6 Mtpa). Edgar Thomson was established in 1875 as Andrew Carnegie's flagship plant. ET still has 2.9 Mtpa raw steel capacity, compared to 2.4 Mtpa in the 1970s. It is the only remaining integrated steel plant in the Pittsburgh Region, once the world’s steel capital. Great Lakes plant was established in 1929 (steelmaking and mills added to an existing blast furnace plant operating since 1904) and merged into National Steel in 1930. Granite City began making steel in 1895 and acquired an adjacent independent iron and coke works in 1951 (two blast furnaces originally built in 1921 and 1926). Granite City Steel was acquired by National Steel in 1971. Capacity at Great Lakes peaked at 6.5 Mtpa in the 1970s and is now 3.8 Mtpa. Iron and steelmaking at Great Lakes was put on indefinite idle from April 2020. The hot strip mill was to follow by end-2020. Only cold rolling and galvanizing will continue in operation. Although it has not been officially abandonned, it seems unlikely Great Lakes will ever resume iron and steelmaking. Granite City capacity is now 2.8 Mtpa, but is operating at around 1.5 Mtpa, using only one of the two blast furnaces. America has only nine remaining integrated steel plants. Only one of these was established after WWII. The other eight plants have been operating between 91 to 125 years, including seven at least 100 years! If the surviving plants are so old, maybe that helps explain why 35 other integrated plants in American have been abandoned in recent decades, under intense market pressure from imports and the growth of mini mills, as well as the surging costs of plant modernisation, environmental costs and pension liability costs. If these nine plants are the only survivors, maybe that suggests that the others were less well located, had less competitive product ranges and less efficient production facilities. In the peak USA steel production year 1974, the ten biggest steel companies had a raw steel capacity of almost 145 Mtpa. US Steel 43.8 Mtpa (10 integrated plants) Bethlehem Steel 28.25 Mtpa (5 integrated plants) Republic Steel 14.15 Mtpa (5 integrated plants) National Steel 11.80 Mtpa (3 integrated plants) Jones & Laughlin Steel 9.56 Mtpa (3 integrated plants) Armco Steel 9.53 Mtpa (3 integrated plants) Youngstown Sheet & Tube 9.50 Mtpa (3 integrated plants) Inland Steel 9.30 Mtpa (1 integrated plant) Wheeling Pittsburgh 5.14 Mtpa (2 integrated plant) Ford Motor Co. 3.75 Mtpa (1 integrated plant) These ten companies in 1974 had a total of 36 integrated steel plants, out of the total 44 integrated plants in USA. Now only US Steel still exists under its original ownership. US Steel’s four integrated plants now have a combined raw steelmaking capacity of 17 Mtpa (or effectively about 13 Mtpa without Great Lakes). The five integrated plants now reassembled into Cleveland-Cliffs have a combined capacity of about 22 Mtpa. Both companies have some additional non-integrated steelmaking plants using electric arc steelmaking. John Groves October 2020 All tons above are US short or net tons of 2000 lbs, except Cleveland-Cliffs iron ore mining capacity, which is still reported in gross tons of 2240 lbs. |

A few days ago I posted comments from the CEO of Cleveland Cliffs predicting it is likely that within a few years Cliffs will start building new EAF shops to avoid the huge investment of relining blast furnaces and maintaining iron ore and coke production infrastructure. At the same time, Cliffs confirmed they will invest in a 100-day reline of Cleveland No.5 blast furnace, starting in March this year. The CEO clearly stated that no BFs will be replaced by EAFs this year, and probably not next year. This topic generated very wide discussion (so far more than 60 comments and 400 likes).Here is the link to that discussion......https://www.facebook.com/groups/1561038727264008/permalink/5130644693636709/Yesterday Cliffs released a new statement that within two months they will be shutting down No.4, the last operating blast furnace at Indiana Harbor West plant (the former YS&T/J&L/LTV Steel plant). The furnace will join No.3 BF on indefinite idle status, so the shut-down is likely to be permanent.Here is the link (more than 130 comments so far)....https://www.facebook.com/groups/1561038727264008/permalink/5135570899810755/The first Cliffs statement two weeks ago says definitely no BFs will be replaced this year and probably not next year. Yesterday's statement appears to contradict this by announcing a BF shut-down almost immediately.But there is no contradiction. IH#4 is NOT being replaced by an EAF. As Cliffs explained, the shut-down of IH#4 has been made possible by a major boost in iron production from the flagship IH#7, relined and enhanced late last year at a cost of $100 million. And also by boosting the scrap consumption in Cliffs BOF steelmaking shops, thus making more raw steel from a given tonnage of molten blast furnace pig iron.The increased blast furnace productivity is a direct result of Cliffs starting to utilise the long proven expertise from Middletown No.3 BF, which uses very high percentages of DRI/HBI and scrap in the furnace charge burden. This has resulted in BF productivity performance unmatched anywhere in the world.Following the reline and changed furnace burden, Cliffs has upgraded the rated capacity of IH#7 to 11,500 metric tonnes per day (12,600 net tons/day).Cliffs CEO also released important background information about a week ago in a 'fireside chat" at a steel industry conference in Tampa. It is well worth reading in full. But note that the timing of this statement fell in between the two statements discussed above.CLIFFS COULD 'STRETCH' HOT METAL AND TAKE DOWN A BLAST FURNACE IN '22: GONCALVESThursday, February 17, 2022 10:43am Written by Michael CowdenPublished in Steel Market UpdateCleveland-Cliffs Inc. might shut a blast furnace this year, the company’s top executive said.“When we make a move, we make a move. … You might see a blast furnace going down for good still in 2022,” Cliffs Chairman, President and CEO Lourenco Goncalves said during a fireside chat at the Tampa Steel Conference this week.While that decision did not appear certain, this much is: If a furnace is taken down, the Cleveland-based steelmaker won’t put it up for sale, Goncalves said.“I hope you saw that the blast furnace in Ashland was demolished with explosives. We brought it down for good,” he added.The Amanda blast furnace in Ashland, Ky. – acquired by Cliffs in its deal for AK Steel – was decommissioned in 2015, according to SMU’s blast furnace status table.There had previously been speculation that the Ashland furnace might be restarted to supply pig iron to EAF steelmakers.Cliffs wouldn’t necessarily shut down a furnace because of poor demand but instead because it can “stretch” its hot metal and produce the same amount using fewer furnaces, Goncalves said.Those comments come after Goncalves said on the Cliffs’ quarterly earnings call last week that the company might consider replacing a blast furnace with an EAF. He also said on that call that the company was shutting its Mountain State Carbon coke plant in Follansbee, W.Va., because it required less coke as a result of increased use of natural gas and pre-reduced raw materials such as hot-briquetted iron (HBI).The Cliffs CEO also said that Sen. Joe Manchin (D. W.Va.) – “a guy who has the power to stop a country like the United States” – had asked him if he might reconsider. Goncalves said he declined to do so.Sen. Manchin’s press staff did not immediately respond to a request for comment from SMU.Such efforts come because Cliffs, like other steelmakers, is working hard to reduce its carbon emissions. But Goncalves said the focus on CO2 emissions from steelmaking in the United States was misplaced.The U.S. steel industry accounts for approximately 1% of the country’s total carbon emissions. Compare that to China’s steel industry, which accounts for 15% of its total CO2 emissions. “That’s night and day. That’s the difference between hell and heaven. And in between you have Europe,” Goncalves quipped.In the U.S., in contrast, tail pipe emissions from vehicles account for 29% of CO2 pollution. That’s why Cleveland, with two blast furnaces, has less pollution than Los Angeles. Or to put it in layman’s terms: “If you are a guy like me - I need to lose weight - if I decide to lose weight by cutting my nails, I’m not going to lose weight,” he joked.Cliffs nonetheless plans to test out using hydrogen to make HBI at its facility in Toledo, Ohio. That will be mostly for demonstration purposes, and then the facility will return to its regular practice of using natural gas. Why does Goncalves not feel the same pressure to convert to hydrogen-based steel production given that similar projects are advancing in Europe? “Europe talks a good game on hydrogen for one reason and one reason only, they have no natural gas. … So they are throwing stuff against the wall to see if it sticks,” he said.He also accused European steelmakers of accepting lavish subsidies to decarbonize. "And now we have a copycat up north in Canada," he said, whose mills he suggested were dumping steel into the U.S.More important to the U.S. in reducing carbon emissions are the country’s car and truck makers switching from internal combustion engines to electric vehicles. That process should happen over the next 10 years and will mark the most revolutionary change for the auto industry since passenger vehicles replaced horses, Goncalves said. And Cliffs expects to remain a big supplier to the automotive industry, not just of carbon steel but also of the electrical steels that will be increasingly in demand for electric vehicles and for charging stations.Cliffs currently sells approximately 5 million tons of steel directly to automakers and another 2-3 million tons indirectly to the sector. Goncalves acknowledged and applauded U.S. EAF steelmakers for making strides into the automotive sector, but pointed out that the market is still dominated by integrated producers. Japanese automakers are supplied primarily by Nippon Steel Corp. and JFE Steel Corp., both integrated steelmakers. And European automakers are supplied primarily by ArcelorMittal, ThyssenKrupp and Voestalpine, also integrated producers.Integrated steelmakers are often assumed to be higher cost. But a singular focus on lower prices – something that has characterized the automotive industry over the last 30-40 years – does not come without a cost. “Guess what they got? No microchips. Because they like cheap stuff,” Goncalves said.And it shouldn’t be assumed that EAF mills will continue to have a price advantage over integrated producers in a world in which prime scrap is getting more and more scarce. “That was true in Ken Iverson’s time but not anymore,” he said referring to the iconic Nucor executive. “Pay attention to that. This is the most visible change going on in the marketplace right now.”That is a function not only of increased demand for prime scrap from new flat rolled EAFs but also of the U.S. offshoring manufacturing – and the prime scrap generated by it. “The more we bring back the ability to supply manufacturing in America, the more we are going to have the ability to eliminate this self-inflicted wound,” he said, arguing that democracy and the middle class had also been casualties of offshoring.In the meantime, don’t count on imported pig iron easing the pressure on prime scrap, especially with tensions soaring between Russia and Ukraine, the two primary pig iron suppliers to the U.S. The conflict centers over Ukraine’s industrial heartland – the equivalent of a battle in the U.S. taking place in Michigan and on the Mesabi Iron Range in Minnesota. “The world is changing, things are getting worse in terms of the geopolitical situation,” Goncalves said.By Michael Cowden, Michael@SteelMarketUpdate.comPictures:No.1 is Indiana Harbor West No.4 blast furnace, Niggemeir photo / Dr. Raymond Boothe color enhancement.Nos.2 & 3 are Indiana Harbor #7 (Madeline 7) from Viktor Macha.

[The number and density of good comments is high enough that I didn't bother to copy any of them. Hopefully, the post link works for you.]

|

| 1 |

|

| 2 |

|

| 3 |

No comments:

Post a Comment