A few days ago I posted comments from the CEO of Cleveland Cliffs predicting it is likely that within a few years Cliffs will start building new EAF shops to avoid the huge investment of relining blast furnaces and maintaining iron ore and coke production infrastructure. At the same time, Cliffs confirmed they will invest in a 100-day reline of Cleveland No.5 blast furnace, starting in March this year. The CEO clearly stated that no BFs will be replaced by EAFs this year, and probably not next year. This topic generated very wide discussion (so far more than 60 comments and 400 likes).

Here is the link to that discussion......

https://www.facebook.com/groups/1561038727264008/permalink/5130644693636709/

Yesterday Cliffs released a new statement that within two months they will be shutting down No.4, the last operating blast furnace at Indiana Harbor West plant (the former YS&T/J&L/LTV Steel plant). The furnace will join No.3 BF on indefinite idle status, so the shut-down is likely to be permanent.

Here is the link (more than 130 comments so far)....

https://www.facebook.com/groups/1561038727264008/permalink/5135570899810755/

The first Cliffs statement two weeks ago says definitely no BFs will be replaced this year and probably not next year. Yesterday's statement appears to contradict this by announcing a BF shut-down almost immediately.

But there is no contradiction. IH#4 is NOT being replaced by an EAF. As Cliffs explained, the shut-down of IH#4 has been made possible by a major boost in iron production from the flagship IH#7, relined and enhanced late last year at a cost of $100 million. And also by boosting the scrap consumption in Cliffs BOF steelmaking shops, thus making more raw steel from a given tonnage of molten blast furnace pig iron.

The increased blast furnace productivity is a direct result of Cliffs starting to utilise the long proven expertise from Middletown No.3 BF, which uses very high percentages of DRI/HBI and scrap in the furnace charge burden. This has resulted in BF productivity performance unmatched anywhere in the world.

Following the reline and changed furnace burden, Cliffs has upgraded the rated capacity of IH#7 to 11,500 metric tonnes per day (12,600 net tons/day).

Cliffs CEO also released important background information about a week ago in a 'fireside chat" at a steel industry conference in Tampa. It is well worth reading in full. But note that the timing of this statement fell in between the two statements discussed above.

CLIFFS COULD 'STRETCH' HOT METAL AND TAKE DOWN A BLAST FURNACE IN '22: GONCALVES

Thursday, February 17, 2022 10:43am Written by Michael Cowden

Published in Steel Market Update

Cleveland-Cliffs Inc. might shut a blast furnace this year, the company’s top executive said.

“When we make a move, we make a move. … You might see a blast furnace going down for good still in 2022,” Cliffs Chairman, President and CEO Lourenco Goncalves said during a fireside chat at the Tampa Steel Conference this week.

While that decision did not appear certain, this much is: If a furnace is taken down, the Cleveland-based steelmaker won’t put it up for sale, Goncalves said.

“I hope you saw that the blast furnace in Ashland was demolished with explosives. We brought it down for good,” he added.

The Amanda blast furnace in Ashland, Ky. – acquired by Cliffs in its deal for AK Steel – was decommissioned in 2015, according to SMU’s blast furnace status table.

There had previously been speculation that the Ashland furnace might be restarted to supply pig iron to EAF steelmakers.

Cliffs wouldn’t necessarily shut down a furnace because of poor demand but instead because it can “stretch” its hot metal and produce the same amount using fewer furnaces, Goncalves said.

Those comments come after Goncalves said on the Cliffs’ quarterly earnings call last week that the company might consider replacing a blast furnace with an EAF. He also said on that call that the company was shutting its Mountain State Carbon coke plant in Follansbee, W.Va., because it required less coke as a result of increased use of natural gas and pre-reduced raw materials such as hot-briquetted iron (HBI).

The Cliffs CEO also said that Sen. Joe Manchin (D. W.Va.) – “a guy who has the power to stop a country like the United States” – had asked him if he might reconsider. Goncalves said he declined to do so.

Sen. Manchin’s press staff did not immediately respond to a request for comment from SMU.

Such efforts come because Cliffs, like other steelmakers, is working hard to reduce its carbon emissions. But Goncalves said the focus on CO2 emissions from steelmaking in the United States was misplaced.

The U.S. steel industry accounts for approximately 1% of the country’s total carbon emissions. Compare that to China’s steel industry, which accounts for 15% of its total CO2 emissions. “That’s night and day. That’s the difference between hell and heaven. And in between you have Europe,” Goncalves quipped.

In the U.S., in contrast, tail pipe emissions from vehicles account for 29% of CO2 pollution. That’s why Cleveland, with two blast furnaces, has less pollution than Los Angeles. Or to put it in layman’s terms: “If you are a guy like me - I need to lose weight - if I decide to lose weight by cutting my nails, I’m not going to lose weight,” he joked.

Cliffs nonetheless plans to test out using hydrogen to make HBI at its facility in Toledo, Ohio. That will be mostly for demonstration purposes, and then the facility will return to its regular practice of using natural gas. Why does Goncalves not feel the same pressure to convert to hydrogen-based steel production given that similar projects are advancing in Europe? “Europe talks a good game on hydrogen for one reason and one reason only, they have no natural gas. … So they are throwing stuff against the wall to see if it sticks,” he said.

He also accused European steelmakers of accepting lavish subsidies to decarbonize. "And now we have a copycat up north in Canada," he said, whose mills he suggested were dumping steel into the U.S.

More important to the U.S. in reducing carbon emissions are the country’s car and truck makers switching from internal combustion engines to electric vehicles. That process should happen over the next 10 years and will mark the most revolutionary change for the auto industry since passenger vehicles replaced horses, Goncalves said. And Cliffs expects to remain a big supplier to the automotive industry, not just of carbon steel but also of the electrical steels that will be increasingly in demand for electric vehicles and for charging stations.

Cliffs currently sells approximately 5 million tons of steel directly to automakers and another 2-3 million tons indirectly to the sector. Goncalves acknowledged and applauded U.S. EAF steelmakers for making strides into the automotive sector, but pointed out that the market is still dominated by integrated producers. Japanese automakers are supplied primarily by Nippon Steel Corp. and JFE Steel Corp., both integrated steelmakers. And European automakers are supplied primarily by ArcelorMittal, ThyssenKrupp and Voestalpine, also integrated producers.

Integrated steelmakers are often assumed to be higher cost. But a singular focus on lower prices – something that has characterized the automotive industry over the last 30-40 years – does not come without a cost. “Guess what they got? No microchips. Because they like cheap stuff,” Goncalves said.

And it shouldn’t be assumed that EAF mills will continue to have a price advantage over integrated producers in a world in which prime scrap is getting more and more scarce. “That was true in Ken Iverson’s time but not anymore,” he said referring to the iconic Nucor executive. “Pay attention to that. This is the most visible change going on in the marketplace right now.”

That is a function not only of increased demand for prime scrap from new flat rolled EAFs but also of the U.S. offshoring manufacturing – and the prime scrap generated by it. “The more we bring back the ability to supply manufacturing in America, the more we are going to have the ability to eliminate this self-inflicted wound,” he said, arguing that democracy and the middle class had also been casualties of offshoring.

In the meantime, don’t count on imported pig iron easing the pressure on prime scrap, especially with tensions soaring between Russia and Ukraine, the two primary pig iron suppliers to the U.S. The conflict centers over Ukraine’s industrial heartland – the equivalent of a battle in the U.S. taking place in Michigan and on the Mesabi Iron Range in Minnesota. “The world is changing, things are getting worse in terms of the geopolitical situation,” Goncalves said.

By Michael Cowden, Michael@SteelMarketUpdate.com

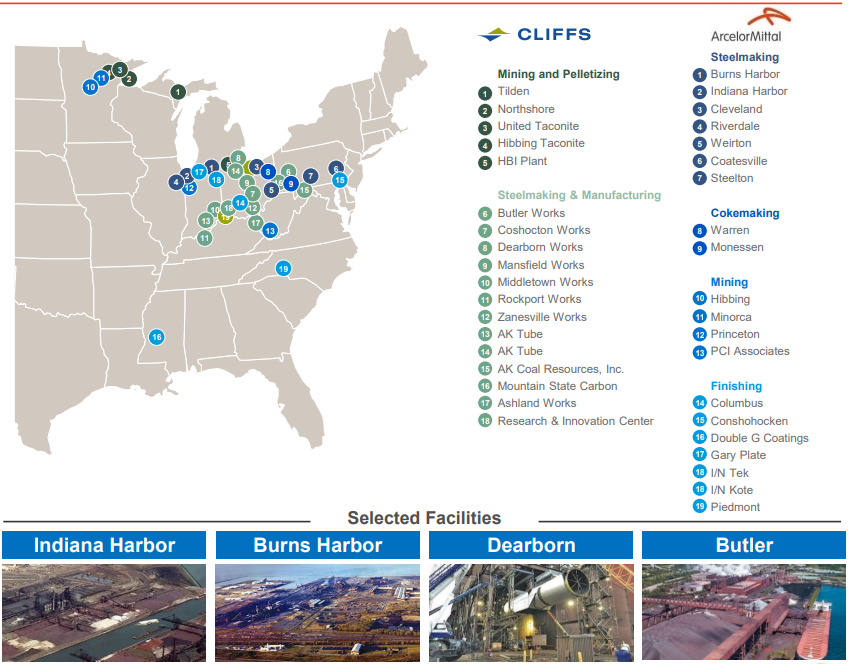

Pictures:

No.1 is Indiana Harbor West No.4 blast furnace, Niggemeir photo / Dr. Raymond Boothe color enhancement.

Nos.2 & 3 are Indiana Harbor #7 (Madeline 7) from Viktor Macha.