Terry Coulter commented on a post: "Steel workers in the U S 1953 650,000. 1980. 399,000. 1984. 236,000. 2015. 142,000." But labor reduction is because it is like farming: more automation and mechanization and bigger machines|furnaces.

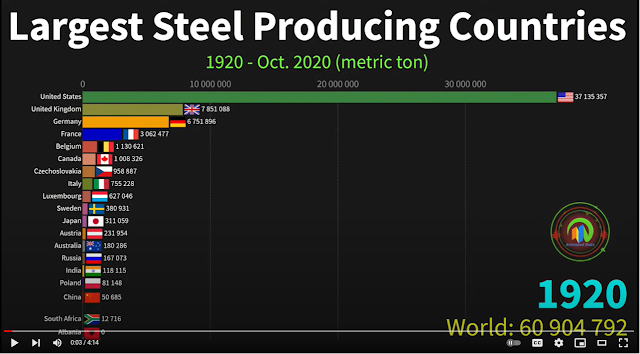

I found this after I wrote the screenshots. This shows China's growth even more clearly.

|

| George Frigm posted Interesting chart on world steel production Dylan O'Hara: Very excited to see the 2021 numbers. I know alot of mills came out of idle last year and this year. I know Nucor has had an amazing year and I'm sure SDI, USS, Cleveland Cliffs, and many of the other major steel producers have had amazing years too. Doug Majka Look up steel pricing at mepsinternational.com. On average across 9 categories of finished product, all of Asia is 41% less than North America. That's huge if you're a buyer looking to build a bridge or skyscraper. |

Recently:

|

| 3:34 |

This is the peak that I found for US. (This was confirmed by a comment by Steve Dunn on a post: "Steel production peaked in 1973, 2nd highest year 2000")

|

| 2:01 |

The post WWII boom:

|

| 1:23 |

Before the depression:

|

| 0:22 |

Their first graph:

|

| 0:03 |

I'm going to generalize these notes to include USA production details.

|

| John Groves posted The 3.4 Mtpa Columbus MS plant of Steel Dynamics Inc, (picture from SDI website). Built in 2007 by ex-Nucor President John Correnti, operated by Severstal until purchased by SDI in 2015 There has been a lot of concern expressed in various threads about US Steel's plan to build another 3 Mtpa flat products mini mill at Osceola, AR. The $3 billion mill will be operating by 2024. Many of comments suggest the new mill is a real threat to the continued operations of US Steel's Mon Valley Works, and probably also to Granite City. Others have speculated it might also be a threat to Cliff's Steel operations at Middletown and Dearborn. But no one has focussed on the reality that the threat is coming from a far wider range of new capacity than just the 3 Mtpa US Steel expansion at Osceola. Today Nucor has announced the site of its 6th flat products mini mill will be in Mason County, WV. This 3 Mtpa mill will be operating by 2024 and will cost $2.7 billion. Nucor has just spent $650 million to double the capacity of its existing Gallatin KY mill to 3 Mtpa by the end of 2021. This will lift the capacity of Nucor's five existing sheet products mills to almost 13 Mtpa, rising to 16 Mtpa after the 6th mill starts up in 2024. Steel Dynamics is right now commissioning it's third flat products mini mill at Sinton TX. It is also 3 Mtpa and has cost $1.9 billion. This will boost SDI's total flat rolled capacity to 9.4 Mtpa. North Star BlueScope at Delta OH is nearing completion of its $750 million project to add almost a million tons per annum to reach 3.0 Mtpa by the middle of this year. Further expansion to 3.5 Mtpa is being planned by de-bottlenecking the hot strip mill. This could be operating by 2024-25 at a cost of around $100 million. In 2019 and 2021, the former owners of Big River Steel received a total of $1.474 billion cash from US Steel for the sale of the 3.3 Mtpa BRS mill now operating at Osceola. This investor group has been negotiating to build a new 3 Mtpa flat products mini mill at Brownsville TX, but no announcement has yet been made. So, in summary current and committed projects: Nucor Gallatin 1.6 Mtpa SDI Sinton 3.0 Mtpa North Star Bluescope 0.9 Mtpa US Steel No.2 Osceola 3.0 Mtpa Nucor Mason County WV 3.0 Mtpa Total extra capacity 11.5 Mtpa Plus probable extra projects planned but not yet committed: North Star BlueScope 0.5 Mtpa Brownsvile project 3.0 Mtpa So the total of current, committed and probable expansion is 15 Mtpa. There are only eight remaining BF-based integrated plants in USA, operated by US Steel and Cleveland Cliffs Steel: USS Gary 7.5 Mtpa USS Mon Valley 2.9 Mtpa USS Granite City 1.5 Mtpa * Cliffs Indiana Harbor 7.5 Mtpa Cliffs Burns Harbor 5.0 Mtpa Cliffs Cleveland 3.5 Mtps Cliffs Middletown 2.9 Mtpa Cliffs Dearborn 2.8 Mtpa * Granite City limited by single BF. So these last eight integrated plants have a combined capacity of 33.8 Mtpa. But they are soon to be assaulted by another 15 Mtpa of new flat products mini mill capacity. Since 1989 a total of nine flat products mini mills came into operation in USA. Their combined capacity reached 23 Mtpa by 2020. They have had a devastating impact on the integrated plants over those three decades. Clearly there will be further casualties in the next few years. The safest probable survivors look to be Gary, Indiana Harbor and Burns Harbor. The other five integrated plants should be feeling very nervous. Bill Winkenhofer: Really good write up John. I think USS Gary will stick around for a while as well as some of the other blast furnace plants but who knows. Mon Valley is not only being pressured by the increase in mini-mill capacity but by Allegheny County as well. Additionally, Mon Valley has a short HSM and makes around a 550 PIW coil whereas the industry is around a 1100 PIW coil size. So their customers have to agree to welds. It has worked well for them in the appliance industry for a long time but going forward might be another story. There is a really good Cold Mill and good coating lines there there but who knows. I hate to say it but I believe Granite City, having a blast furnace idled put the handwriting on the wall for them. It does not seem that USS is willing to spend the money needed at Granite City. I would hate to see these plants close because there are really great dedicated people at both facilities. New mini-mills can be built utilizing the latest technology to offset the environmentalist concerns until they switch to EAF dust. John Groves posted, but it has the same comments. |

|

| John Groves posted THE BIG FOUR OF THE AMERICAN STEEL INDUSTRY According to the American Iron and Steel Institute, total USA shipments of steel products in 2021 was 94.7 million net tons. This was an increase of 16.9% on the full year 2020. There are about fifty steelmaking companies operating a total of almost one hundred steelmaking plants in USA, including eight integrated plants using blast furnaces, and around ninety mini mills and specialty steel plants using electric arc furnaces. But I was quite surprised when I totalled the steel shipment numbers for the four big guys of the USA steel industry. The four biggest American steel companies shipped just over SEVENTY PERCENT of the total American steel shipments for 2021. Nucor shipped 28.2 million net tons (29.8% of the total shipments) Cleveland-Cliffs 15.9 million tons (16.8%) US Steel 11.7 million tons (12.3%) Steel Dynamics (SDI) 11.2 million tons (11.8%) Total for the Big Four 67.0 million tons 70.7% (Note: US Steel shipped another 4.3 M tons last year from its integrated mill in Slovakia) The picture [above] is Nucor's Berkeley mill in South Carolina, established in 1996 as the third of Nucor's flat products mills after Crawfordsville and Blytheville. In 1998 a beam blank caster and medium beam mill were added, and in 2000 a second thin slab caster added. This mill now has a raw steelmaking capacity of 3.260 M net tons/annum, hot rolled coil capacity of 2.500 M tons and medium beam rolling capacity of 0.800 M tons. In addition, Berkeley has two single-stand cold reversing mills (total capacity 1.250 M tons/annum) and one galvanizing line (0.700 M tons). Very impressive facilities lineup for a "mini mill". The picture shows the melt shop at the centre right, the hot strip mill running diagonally down to the lower center and the cold mills and galv line at the centre left. The medium beam mill runs diagonally up from the melt shop to the center left. Dom Piscione: I just hope the Mon Valley can last with US putting 3 billion into arc furnaces in Arkansas. Brian Olson: Kris Smith I hate to be mister negative but Mon Valley making money now doesn't guarantee anything for the future. One of my uncles, who worked for US Steel, told me that National Duquesne Works was very profitable in 1982 but then the market for seamless tube collapsed in 1983 and they shut it all down in 1983. Things can turn that fast. My problem with Mon Valley works is it is a land locked plant from the standpoint of iron ore and it has two of the oldest, smallest blast furnaces in the industry. The last major major capital money spent was 1992. ET and 80" hot mill will not survive the next down turn. Matt Swartz: It will be 21 years at Steel Dynamics Flat Roll Group Butler Division in June. With Sinton coming on line, we may just be #3 very soon. Love the people I work with. Stay safe all! |

No comments:

Post a Comment